I remember standing in my kitchen, a crumpled college application in one hand and a calculator in the other, staring at the tuition fees. The numbers swam before my eyes, each digit a tiny brick adding to a wall that seemed insurmountable. College had always been the whisper of a dream, a bright light at the end of a long tunnel, but that day, it felt like an impossible luxury. My parents worked tirelessly, but their earnings were just enough to keep us afloat, never enough to build a college fund. That feeling of despair, of watching a future slip away because of money, is something I wouldn’t wish on anyone. If you’re reading this, perhaps you’ve felt that knot in your stomach too, that gnawing worry about how to afford higher education.

That’s where my journey with "need-based financial aid scholarships" began. Before then, these words were just a jumble of bureaucratic jargon. I thought scholarships were only for the super-geniuses or the star athletes, certainly not for a regular kid like me whose biggest talent was probably worrying. But I was wrong, gloriously, wonderfully wrong. Need-based aid isn’t about how smart you are, or how many touchdowns you score; it’s about whether your family can genuinely afford the cost of college, and if they can’t, it’s there to bridge that gap. It’s a lifeline, a bridge built of compassion and opportunity, designed to ensure that talent and potential aren’t wasted simply because of economic circumstances.

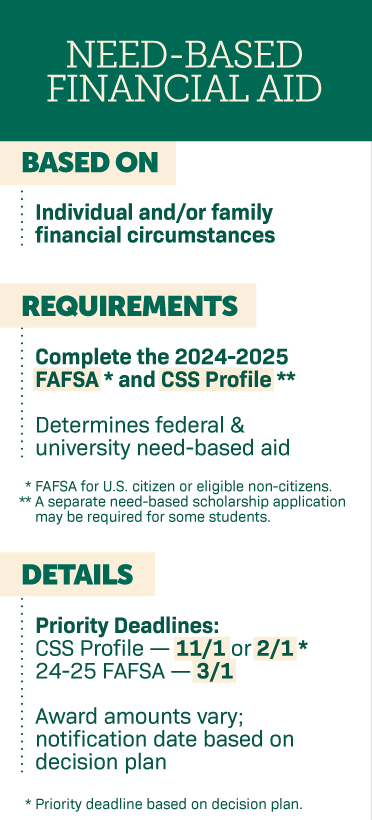

My high school counselor, bless her patient soul, was the first one to truly explain it to me. She saw the worry etched on my face and handed me a thick packet of forms, mostly about something called the FAFSA and the CSS Profile. She said, "Don’t let the price tag scare you. Colleges want you, and many of them have money set aside specifically to help students like you afford to come." Her words were a balm, a spark of hope in the financial gloom. She explained that need-based financial aid isn’t just one thing; it’s a whole ecosystem of support that includes grants, work-study programs, and yes, need-based scholarships.

Let’s break down what that means, because understanding these terms was my first step out of the financial fog. At its core, need-based aid is determined by calculating your "financial need." This isn’t some mystical formula; it’s a pretty straightforward subtraction problem:

Cost of Attendance (COA) – Expected Family Contribution (EFC) = Financial Need

The Cost of Attendance (COA) isn’t just tuition. It’s the whole package: tuition and fees, room and board, books and supplies, transportation, and even personal expenses. It’s the total estimated cost for you to attend that particular school for a year. This number varies wildly from college to college, which is why researching different schools’ COAs was an eye-opener. Some schools, despite their hefty sticker price, might offer more generous aid packages, making them more affordable in the long run than a seemingly cheaper option.

Then there’s the Expected Family Contribution (EFC). This number, now sometimes called the Student Aid Index (SAI) for federal aid, is what the government and colleges think your family can reasonably afford to pay for one year of college. It’s calculated based on the information you provide in those infamous forms: the FAFSA (Free Application for Federal Student Aid) and, for many private and more selective schools, the CSS Profile. These forms dig deep into your family’s income, assets, household size, and other financial details. It felt invasive at first, laying bare our family’s financial life, but I quickly realized it was a necessary step, the key to unlocking the help I needed. The lower your EFC/SAI, the higher your calculated financial need, and thus, the more aid you’re likely to qualify for.

Once your financial need is determined, colleges and the government then try to "meet" that need through various types of aid. This is where need-based financial aid scholarships come into play, alongside other crucial components.

Grants: These were my favorite words. Grants are essentially free money that you don’t have to pay back. They come from the federal government (like the Pell Grant, which was a huge help for me), state governments, and even directly from the colleges themselves. Many institutional grants are specifically need-based, meaning they are awarded based on your financial circumstances, not just academic merit. I remember the relief of seeing a substantial grant amount on my financial aid award letter; it was like a heavy weight being lifted from my shoulders.

Work-Study: This program allows students to earn money through part-time jobs, usually on campus, to help pay for educational expenses. The funds are often subsidized by the federal government, making it a win-win: you gain valuable work experience, and you earn money without taking on more loans. My work-study job in the campus library taught me responsibility and helped cover my textbook costs, which added up faster than I ever imagined.

Loans: While not "free money," loans are also part of many financial aid packages. Federal student loans often have lower interest rates and more flexible repayment options than private loans, making them a more manageable option if you need to borrow. My counselor always emphasized focusing on grants and scholarships first, and only borrowing what was absolutely necessary. This advice stuck with me, and I tried my best to minimize my loan burden.

And then, there are the Need-Based Scholarships. These are the gems. Unlike merit scholarships, which reward academic achievements or specific talents, need-based scholarships are awarded primarily because your family demonstrates financial need. They can come from the college itself, private organizations, community groups, or even generous individuals. These scholarships are often designed to fill the remaining gap between your financial need and the grants and work-study you might receive. They are a direct investment in you, recognizing that your potential shouldn’t be limited by your family’s bank account.

My application process felt like a marathon. First, the FAFSA. It’s online, but it requires detailed information from your parents’ tax returns, bank statements, and investment records. My mom and I sat together for hours, sifting through documents, calling our accountant with questions. It felt overwhelming at times, like trying to solve a puzzle with a thousand tiny pieces. But we persevered. The CSS Profile was even more detailed, asking questions about home equity, medical expenses, and even business assets, providing a more holistic picture of our family’s financial situation to the colleges that use it.

Deadlines became my obsession. I marked them on every calendar, set reminders on my phone. Missing a deadline for the FAFSA or CSS Profile can mean missing out on thousands of dollars in aid, a risk I couldn’t afford to take. Some institutional need-based scholarships also had their own separate application processes and deadlines, often requiring essays that delved into my personal story, my challenges, and my aspirations.

Those essays were tough but incredibly rewarding. I had to articulate why I needed the aid, how it would make a difference, and what my goals were. It wasn’t about exaggerating hardship, but about being honest and vulnerable. I wrote about my parents’ sacrifices, my dreams of being the first in my family to earn a degree, and how college would empower me to give back to my community. It felt like laying my heart on paper, and it was through this process that I truly understood the value of what I was seeking.

Finding need-based scholarships wasn’t always straightforward. My high school counselor was an invaluable resource, pointing me to local scholarships from community foundations and rotary clubs. I also spent countless hours online, sifting through scholarship search engines. The key, I learned, was to be very specific with my search filters: "need-based," "first-generation student," "local," "major-specific." Many of these private scholarships weren’t huge sums individually – sometimes $500, sometimes $1,000 – but they added up. Each one was a small victory, a testament to the fact that people believed in the power of education and wanted to help students like me succeed.

One particular need-based scholarship application stands out in my memory. It was from a local foundation, and it required an interview. I was terrified. Dressed in my best (and only) suit, I walked into a room full of stern-looking adults. They asked about my family, my grades, my extracurriculars, and most importantly, how I planned to use my education to impact the world. I spoke from the heart, my voice trembling at first, but gaining confidence as I talked about my passion for learning and my desire to create positive change. When I received the letter saying I had been awarded that scholarship, I cried tears of relief and gratitude. It wasn’t just money; it was validation.

My biggest piece of advice to anyone navigating this labyrinth is to start early. The earlier you begin researching, gathering documents, and filling out forms, the better. Don’t wait until senior year to think about college costs. Begin understanding the FAFSA and CSS Profile in your junior year, and talk openly with your parents about your family’s financial situation.

Another crucial tip: don’t be afraid to ask for help. My counselor, college financial aid officers, and even online forums were instrumental in guiding me through confusing sections of forms or clarifying specific policies. There are people whose job it is to help you understand this, so use them! And remember, financial aid award letters can sometimes be negotiated. If you receive a better offer from one school, or if your family’s financial situation changes, don’t hesitate to reach out to the financial aid office of your preferred school to see if they can reconsider their package. It’s called an appeal, and it can make a real difference.

The cumulative effect of all these need-based financial aid scholarships, grants, and work-study programs was profound. When my final financial aid award letter arrived from my dream school, it wasn’t a wall of numbers anymore; it was a carefully constructed bridge. The university had met nearly all of my demonstrated financial need through a combination of institutional grants and need-based scholarships, along with a manageable federal loan and a work-study offer. I was going to college. Not just a college, but my college.

The journey was challenging, filled with paperwork, deadlines, and moments of doubt. But looking back, it was also incredibly empowering. It taught me perseverance, organizational skills, and the importance of advocating for myself. Need-based financial aid scholarships weren’t just about money; they were about equity, about opening doors that might otherwise remain shut. They allowed me to pursue an education that transformed my life, opened my mind to new ideas, and connected me with people from all walks of life.

If you’re out there, feeling that familiar knot of worry about affording college, please know this: there is help available. The system might seem complex and daunting, but it’s designed to support students like you. Don’t let the sticker price deter you. Dive into the FAFSA and CSS Profile, research those need-based scholarships, and tell your story. Be persistent, be honest, and believe in your potential. Your dream of higher education is within reach, and with the right support, you too can build your bridge to a brighter future.